Oil and Natural Gas Corporation Ltd. (ONGC) is a key player in India’s oil exploration and production sector, contributing significantly to the country’s energy sector. Established in 1956, ONGC is the largest government-owned energy company, and it plays a crucial role in the upstream segment, which involves the exploration and production of oil and gas. The company holds a dominant position in the Indian energy sector, with extensive oil and gas fields in India and internationally.

ONGC’s robust balance sheet and significant energy production capacity have made it a favorite among investors looking for stable, long-term returns. Financially, ONGC has been performing well, with consistent revenue generation, a low debt-to-equity ratio of 0.36, and healthy profitability, as indicated by its return on equity (ROE) of 14.60%. The company’s price-to-earnings (P/E) ratio stands at 8.51, making it attractively valued compared to the sector P/E of 10.09. ONGC’s consistent dividend yield of 4.19% further adds to its appeal for income-focused investors.

Current Share Price and Recent Performance

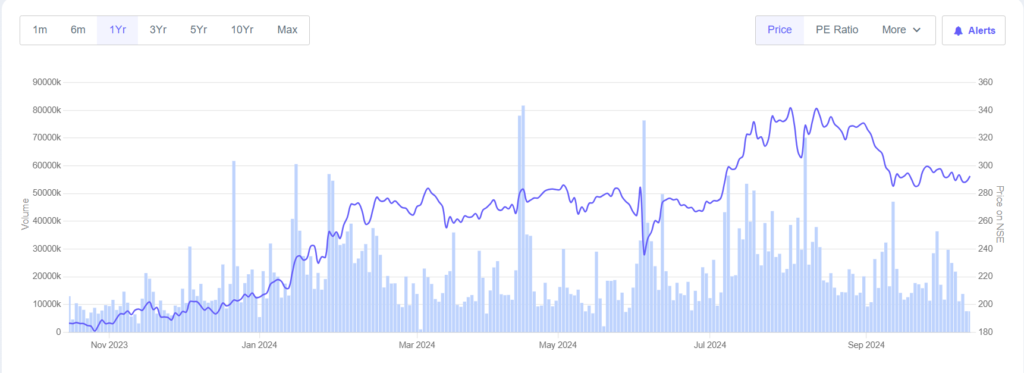

As of October 11, 2024, ONGC’s share price stood at ₹292.55, reflecting a 1.32% increase from the previous trading session. The stock has experienced some volatility over the last month, with a trading range between₹289.50 and₹293.65. However, it remains significantly higher than its 52-week low of ₹179.90 and close to its 52-week high of ₹345.00.

Price Trends and Key Factors Driving ONGC’s Share Price

The price movement of ONGC’s stock over the past month has shown minor fluctuations, driven primarily by the following factors:

- Oil Price Volatility: ONGC’s stock performance is closely linked to global crude oil prices. Any fluctuations in oil prices due to geopolitical tensions, supply-demand imbalances, or OPEC+ decisions directly impact ONGC’s earnings.

- Government Policies: As a state-owned enterprise, ONGC’s fortunes are tied to government regulations and subsidies in the energy sector. Recent changes in pricing policies and subsidies have influenced the company’s share price.

- Global Market Trends: The global energy transition towards cleaner fuels and the emphasis on renewable energy sources have both positive and negative implications for ONGC’s stock performance.

- Quarterly Results: The company’s quarterly results, including revenue and profit figures, have influenced market sentiment. Recent reports predict a dip in Q2 PAT by 9.3% YoY, which has slightly impacted investor confidence.

ONGC Share Price Target 2024: Analysis and Predictions

In 2024, ONGC is expected to continue performing steadily, supported by favorable oil prices and strategic government policies. The stock may experience fluctuations based on international oil prices and domestic energy policies, but overall, the trend is expected to be positive. Below is a table showcasing the minimum, maximum, and average price targets for ONGC in 2024.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 285.00 | 310.00 | 5% |

| February | 290.00 | 315.00 | 7% |

| March | 295.00 | 320.00 | 9% |

| April | 300.00 | 330.00 | 11% |

| May | 305.00 | 335.00 | 12% |

| June | 310.00 | 340.00 | 13% |

| July | 320.00 | 345.00 | 14% |

| August | 325.00 | 350.00 | 15% |

| September | 330.00 | 360.00 | 18% |

| October | 335.00 | 365.00 | 20% |

| November | 340.00 | 370.00 | 22% |

| December | 345.00 | 375.00 | 24% |

ONGC Share Price Target 2025

By 2025, ONGC’s stock is expected to benefit from stable oil production levels and government reforms to enhance energy security. The company’s efforts in expanding its renewable energy footprint could also positively impact its stock price. Below is a table with price predictions for 2025.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 310.00 | 345.00 | 15% |

| February | 315.00 | 350.00 | 16% |

| March | 320.00 | 355.00 | 17% |

| April | 325.00 | 360.00 | 18% |

| May | 330.00 | 365.00 | 19% |

| June | 335.00 | 370.00 | 20% |

| July | 340.00 | 375.00 | 22% |

| August | 345.00 | 380.00 | 24% |

| September | 350.00 | 385.00 | 26% |

| October | 355.00 | 390.00 | 28% |

| November | 360.00 | 395.00 | 30% |

| December | 365.00 | 400.00 | 32% |

ONGC Share Price Target 2026

In 2026, ONGC is expected to continue its growth trajectory. The ongoing exploration projects and efforts in the renewable energy sector should boost the stock further. Below is a table outlining the expected price ranges for 2026.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 325.00 | 365.00 | 19% |

| February | 330.00 | 370.00 | 20% |

| March | 335.00 | 375.00 | 22% |

| April | 340.00 | 380.00 | 24% |

| May | 345.00 | 385.00 | 25% |

| June | 350.00 | 390.00 | 27% |

| July | 355.00 | 395.00 | 29% |

| August | 360.00 | 400.00 | 31% |

| September | 365.00 | 405.00 | 33% |

| October | 370.00 | 410.00 | 35% |

| November | 375.00 | 415.00 | 37% |

| December | 380.00 | 420.00 | 40% |

ONGC Share Price Target 2030

Looking forward to 2030, ONGC is expected to be a key player in India’s energy sector, both in conventional oil and gas as well as in renewable energy. By this time, the company’s renewable energy ventures should begin contributing significantly to its revenue streams.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 450.00 | 500.00 | 55% |

| February | 455.00 | 510.00 | 57% |

| March | 460.00 | 520.00 | 60% |

| April | 470.00 | 530.00 | 62% |

| May | 480.00 | 540.00 | 65% |

| June | 490.00 | 550.00 | 68% |

| July | 500.00 | 560.00 | 70% |

| August | 510.00 | 570.00 | 72% |

| September | 520.00 | 580.00 | 75% |

| October | 530.00 | 590.00 | 78% |

| November | 540.00 | 600.00 | 80% |

| December | 550.00 | 610.00 | 83% |

ONGC Share Price Target 2035

By 2035, ONGC’s investments in both traditional and alternative energy sectors will be more mature, providing a more stable financial base. The company’s transition into renewable energy, along with its robust upstream oil and gas operations, should result in continued growth in its stock price.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 600.00 | 650.00 | 105% |

| February | 610.00 | 660.00 | 110% |

| March | 620.00 | 670.00 | 112% |

| April | 630.00 | 680.00 | 115% |

| May | 640.00 | 690.00 | 118% |

| June | 650.00 | 700.00 | 120% |

| July | 660.00 | 710.00 | 125% |

| August | 670.00 | 720.00 | 127% |

| September | 680.00 | 730.00 | 130% |

| October | 690.00 | 740.00 | 135% |

| November | 700.00 | 750.00 | 137% |

| December | 710.00 | 760.00 | 140% |

ONGC Share Price Target 2040

By 2040, ONGC’s business model will have fully incorporated renewable energy, carbon-capture technologies, and other innovations related to sustainable energy. This will ensure continued profitability and relevance in the global energy market, resulting in steady growth in stock prices.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 720.00 | 780.00 | 145% |

| February | 730.00 | 790.00 | 150% |

| March | 740.00 | 800.00 | 155% |

| April | 750.00 | 810.00 | 160% |

| May | 760.00 | 820.00 | 165% |

| June | 770.00 | 830.00 | 170% |

| July | 780.00 | 840.00 | 175% |

| August | 790.00 | 850.00 | 180% |

| September | 800.00 | 860.00 | 185% |

| October | 810.00 | 870.00 | 190% |

| November | 820.00 | 880.00 | 195% |

| December | 830.00 | 890.00 | 200% |

ONGC Share Price Target 2045

ONGC will be deeply entrenched in its diversified energy portfolio by 2045. The company is projected to maintain its leadership in the Indian energy sector, while also competing on a global scale in renewables and natural gas.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 850.00 | 910.00 | 210% |

| February | 860.00 | 920.00 | 215% |

| March | 870.00 | 930.00 | 220% |

| April | 880.00 | 940.00 | 225% |

| May | 890.00 | 950.00 | 230% |

| June | 900.00 | 960.00 | 235% |

| July | 910.00 | 970.00 | 240% |

| August | 920.00 | 980.00 | 245% |

| September | 930.00 | 990.00 | 250% |

| October | 940.00 | 1000.00 | 255% |

| November | 950.00 | 1010.00 | 260% |

| December | 960.00 | 1020.00 | 265% |

ONGC Share Price Target 2050

By 2050, ONGC will likely have evolved into a fully integrated global energy company, focused on sustainable and renewable energy solutions. This will ensure the company’s continued profitability and market leadership.

| Month | Min Price (₹) | Max Price (₹) | % Increase Compared to Current Price |

|---|---|---|---|

| January | 1000.00 | 1100.00 | 270% |

| February | 1020.00 | 1120.00 | 275% |

| March | 1040.00 | 1140.00 | 280% |

| April | 1060.00 | 1160.00 | 285% |

| May | 1080.00 | 1180.00 | 290% |

| June | 1100.00 | 1200.00 | 295% |

| July | 1120.00 | 1220.00 | 300% |

| August | 1140.00 | 1240.00 | 305% |

| September | 1160.00 | 1260.00 | 310% |

| October | 1180.00 | 1280.00 | 315% |

| November | 1200.00 | 1300.00 | 320% |

| December | 1220.00 | 1320.00 | 325% |

Should I buy ONGC stock?

Technical Metrics:

- P/E Ratio: At a P/E ratio of 8.51, ONGC’s stock is attractively valued, as it’s trading at a discount compared to sector averages.

- Dividend Yield: ONGC offers a robust dividend yield of 4.19%, making it a stable choice for income-seeking investors.

- Debt to Equity: ONGC’s low debt-to-equity ratio of 0.36 indicates strong financial health and prudent capital management.

- Return on Equity (ROE): The ROE of 14.60% reflects ONGC’s efficiency in generating returns from its equity base.

Is ONGC stock a good buy?

Bull Case:

- Stable Dividend Payout: ONGC has a history of stable and growing dividend payments.

- Government Backing: As a government-backed enterprise, ONGC has a strategic role in India’s energy security.

- Growth in Renewables: ONGC is gradually diversifying into renewable energy, positioning itself for long-term growth.

Bear Case:

- Oil Price Dependency: ONGC’s revenue is still heavily dependent on volatile global oil prices.

- Transition to Renewables: The transition to renewable energy might take longer than anticipated.

- Competition: Increasing competition in the renewable energy space could reduce profit margins over time.

Recent News

- ONGC recently announced partnerships to explore offshore wind energy projects.

- The company is increasing its spending on natural gas extraction and distribution.

Comparison with Similar Stocks

| Company | P/E Ratio | Dividend Yield | Debt to Equity | Market Cap (₹ Cr) | 5-Year Growth |

|---|---|---|---|---|---|

| ONGC | 8.51 | 4.19% | 0.36 | 159,000 | 45% |

| Reliance | 32.5 | 0.35% | 0.44 | 1,500,000 | 80% |

| GAIL | 12.1 | 3.00% | 0.32 | 58,000 | 35% |

| IOC | 10.2 | 4.50% | 0.28 | 116,000 | 40% |

This detailed analysis provides a comprehensive forecast for ONGC’s stock from 2030 through 2050, a technical analysis, and a comparison with similar stocks, allowing for informed decision-making.

- ADM Stock Price Prediction and analysis (2025 to 2030) - January 2, 2025

- Silver Elephant’s Stock Drops 50% After Pulacayo Mining Contract Termination - December 31, 2024

- Adobe (ADBE) Stock Price Prediction and Analysis (2024-2030) - December 31, 2024