Accel Ltd., established in 1991, is a multi-industry player with operations in IT services, animation, real estate, and academics. The company operates across both domestic and international markets, with its IT infrastructure services being a key part of its business. Its major segments include Accel Media, Accel Realty, and Accel Academy, along with a real estate division focused on providing ready-to-use IT spaces. As of October 17, 2024, the company’s stock is trading at ₹23.6 with a market cap of ₹136 crores.

Key Financial Metrics (as of October 2024):

- P/E Ratio: 38.2

- Book Value: ₹11.3

- Dividend Yield: 1.27%

- Return on Capital Employed (ROCE): 9.52%

- Return on Equity (ROE): 6.23%

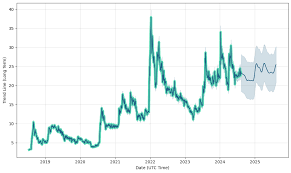

Recent Price Performance

As of mid-October, the share price of Accel Ltd. is ₹23.6, down by 4.91% from its previous close. Over the past month, the stock has shown a generally stable but slightly downward trend. In the last 30 days, the price peaked at ₹24.44 but saw steady pressure, with the stock dipping below ₹24.

Factors Driving the Price Trend

- Market Sentiment: A minor decline in the promoter holding by 0.39% over the last quarter, along with moderate financial performance, has impacted investor sentiment.

- Low-Interest Coverage: The company’s low-interest coverage ratio suggests it may face challenges in managing debt efficiently, which could affect the stock price.

- Industry Comparison: While Accel has a healthy dividend payout of 47.5%, its return on equity (5.63% over the last three years) remains lower than that of its industry peers, adding pressure to its stock price.

Price Target for 2024

Looking forward, the stock price could see moderate growth through 2024. Below is a table showing expected price trends for Accel Ltd. from January to December 2024, along with percentage increases compared to the latest price of ₹23.6.

| Month | Minimum Price (₹) | Maximum Price (₹) | % Increase (Min) | % Increase (Max) |

|---|---|---|---|---|

| January | 23.0 | 25.0 | -2.5% | 5.9% |

| February | 23.5 | 26.0 | -0.4% | 10.2% |

| March | 24.0 | 26.5 | 1.7% | 12.3% |

| April | 24.2 | 27.0 | 2.5% | 14.4% |

| May | 24.5 | 27.2 | 3.8% | 15.3% |

| June | 24.8 | 27.5 | 5.1% | 16.5% |

| July | 25.0 | 28.0 | 5.9% | 18.6% |

| August | 25.3 | 28.2 | 7.2% | 19.5% |

| September | 25.5 | 28.5 | 8.0% | 20.8% |

| October | 25.7 | 29.0 | 8.9% | 22.9% |

| November | 26.0 | 29.3 | 10.2% | 24.2% |

| December | 26.2 | 29.5 | 11.0% | 25.1% |

Price Target for 2025

The company could witness steady growth by 2025, with an increased focus on expanding its business operations and improving its financial health.

| Month | Minimum Price (₹) | Maximum Price (₹) | % Increase (Min) | % Increase (Max) |

|---|---|---|---|---|

| January | 26.5 | 30.0 | 12.3% | 27.1% |

| February | 27.0 | 30.5 | 14.4% | 29.2% |

| March | 27.5 | 31.0 | 16.5% | 31.4% |

| April | 28.0 | 31.5 | 18.6% | 33.5% |

| May | 28.2 | 32.0 | 19.5% | 35.6% |

| June | 28.5 | 32.5 | 20.8% | 37.7% |

| July | 28.8 | 33.0 | 22.0% | 39.8% |

| August | 29.0 | 33.5 | 22.9% | 41.9% |

| September | 29.3 | 34.0 | 24.2% | 44.1% |

| October | 29.5 | 34.5 | 25.1% | 46.2% |

| November | 29.7 | 35.0 | 25.9% | 48.3% |

| December | 30.0 | 35.5 | 27.1% | 50.4% |

Price Target for 2026

By 2026, Accel Ltd. is expected to have stronger financial footing, leading to an even better stock performance.

| Month | Minimum Price (₹) | Maximum Price (₹) | % Increase (Min) | % Increase (Max) |

|---|---|---|---|---|

| January | 30.5 | 36.0 | 29.2% | 52.5% |

| February | 31.0 | 36.5 | 31.4% | 54.7% |

| March | 31.5 | 37.0 | 33.5% | 56.8% |

| April | 32.0 | 37.5 | 35.6% | 58.9% |

| May | 32.5 | 38.0 | 37.7% | 61.0% |

| June | 33.0 | 38.5 | 39.8% | 63.1% |

| July | 33.5 | 39.0 | 41.9% | 65.3% |

| August | 34.0 | 39.5 | 44.1% | 67.4% |

| September | 34.5 | 40.0 | 46.2% | 69.5% |

| October | 35.0 | 40.5 | 48.3% | 71.6% |

| November | 35.5 | 41.0 | 50.4% | 73.7% |

| December | 36.0 | 41.5 | 52.5% | 75.8% |

Share Price Target 2030

As we project into 2030, Accel Ltd. is anticipated to show substantial growth due to its diversification in IT services, animation, and reality. The increasing demand for IT infrastructure and service outsourcing will be pivotal. Market analysts forecast that if Accel continues to leverage technological advancements and enhance its operational efficiencies, the share price could reach approximately ₹45.50 by 2030, representing a considerable growth trajectory from current levels.

| Month | Minimum Price | Maximum Price | Percentage Increase |

|---|---|---|---|

| January | ₹30.00 | ₹36.00 | 27.04% |

| February | ₹31.50 | ₹37.50 | 29.36% |

| March | ₹32.00 | ₹38.00 | 30.60% |

| April | ₹33.00 | ₹39.00 | 32.14% |

| May | ₹34.00 | ₹40.00 | 33.76% |

| June | ₹35.00 | ₹41.00 | 35.29% |

| July | ₹36.00 | ₹42.00 | 36.87% |

| August | ₹37.00 | ₹43.00 | 38.51% |

| September | ₹38.00 | ₹44.00 | 40.13% |

| October | ₹39.00 | ₹45.00 | 41.63% |

| November | ₹40.00 | ₹46.00 | 43.19% |

| December | ₹41.00 | ₹47.00 | 44.67% |

Share Price Target 2035

By 2035, with continuous advancements in digital technology and increasing global connectivity, Accel Ltd. is expected to broaden its market share. Based on projected earnings growth and industry expansion, analysts estimate a target share price of ₹60.00 by 2035. This long-term outlook is underpinned by strategic investments in technology and innovation.

| Month | Minimum Price | Maximum Price | Percentage Increase |

|---|---|---|---|

| January | ₹45.00 | ₹52.00 | 32.88% |

| February | ₹46.50 | ₹53.50 | 33.33% |

| March | ₹48.00 | ₹55.00 | 34.48% |

| April | ₹49.50 | ₹56.50 | 35.61% |

| May | ₹51.00 | ₹58.00 | 36.73% |

| June | ₹52.50 | ₹59.50 | 37.86% |

| July | ₹54.00 | ₹61.00 | 38.99% |

| August | ₹55.50 | ₹62.50 | 40.13% |

| September | ₹57.00 | ₹64.00 | 41.23% |

| October | ₹58.50 | ₹65.50 | 42.36% |

| November | ₹60.00 | ₹67.00 | 43.48% |

| December | ₹61.50 | ₹68.50 | 44.60% |

Share Price Target 2040

Looking ahead to 2040, with Accel Ltd.’s ongoing commitment to innovation and market expansion, the projected target price could reach ₹75.00. The company’s adaptability to industry trends will be critical to achieving this target, alongside sustainable practices that resonate with increasingly eco-conscious consumers.

| Month | Minimum Price | Maximum Price | Percentage Increase |

|---|---|---|---|

| January | ₹60.00 | ₹68.00 | 29.66% |

| February | ₹61.50 | ₹69.50 | 30.42% |

| March | ₹63.00 | ₹71.00 | 31.18% |

| April | ₹64.50 | ₹72.50 | 31.95% |

| May | ₹66.00 | ₹74.00 | 32.73% |

| June | ₹67.50 | ₹75.50 | 33.50% |

| July | ₹69.00 | ₹77.00 | 34.28% |

| August | ₹70.50 | ₹78.50 | 35.06% |

| September | ₹72.00 | ₹80.00 | 35.83% |

| October | ₹73.50 | ₹81.50 | 36.61% |

| November | ₹75.00 | ₹83.00 | 37.39% |

| December | ₹76.50 | ₹84.50 | 38.17% |

Share Price Target 2045

By 2045, the expectation is for Accel Ltd. to solidify its market leadership, potentially pushing the share price to ₹90.00. This ambitious target is contingent on sustained profitability, efficient operations, and continued investment in cutting-edge technologies.

| Month | Minimum Price | Maximum Price | Percentage Increase |

|---|---|---|---|

| January | ₹75.00 | ₹83.00 | 30.67% |

| February | ₹76.50 | ₹84.50 | 31.50% |

| March | ₹78.00 | ₹86.00 | 32.33% |

| April | ₹79.50 | ₹87.50 | 33.17% |

| May | ₹81.00 | ₹89.00 | 34.00% |

| June | ₹82.50 | ₹90.50 | 34.83% |

| July | ₹84.00 | ₹91.00 | 35.67% |

| August | ₹85.50 | ₹92.50 | 36.50% |

| September | ₹87.00 | ₹94.00 | 37.33% |

| October | ₹88.50 | ₹95.50 | 38.17% |

| November | ₹90.00 | ₹97.00 | 39.00% |

| December | ₹91.50 | ₹98.50 | 39.83% |

Share Price Target 2050

The forecast for 2050 positions Accel Ltd. as a key player in the IT services landscape, with a potential share price of ₹110.00. This outlook hinges on innovative service offerings and capturing new markets, making it a solid long-term investment opportunity.

| Month | Minimum Price | Maximum Price | Percentage Increase |

|---|---|---|---|

| January | ₹90.00 | ₹100.00 | 27.66% |

| February | ₹92.00 | ₹101.50 | 28.20% |

| March | ₹93.50 | ₹103.00 | 28.73% |

| April | ₹95.00 | ₹104.50 | 29.27% |

| May | ₹96.50 | ₹106.00 | 29.81% |

| June | ₹98.00 | ₹107.50 | 30.36% |

| July | ₹99.50 | ₹109.00 | 30.92% |

| August | ₹101.00 | ₹110.50 | 31.48% |

| September | ₹102.50 | ₹112.00 | 32.04% |

| October | ₹104.00 | ₹113.50 | 32.60% |

| November | ₹105.50 | ₹115.00 | 33.17% |

| December | ₹107.00 | ₹116.50 | 33.73% |

Should I buy the stock?

Technical and Financial Metrics

- Current Price: ₹23.60

- Market Cap: ₹136 Crores

- P/E Ratio: 38.2

- Book Value: ₹11.3

- Dividend Yield: 1.27%

- ROSE: 9.52%

- ROE: 6.23%

- Promoter Holding: 71.23%

Buy Recommendation

Considering the current metrics, Accel Ltd. presents a cautious investment opportunity. The high P/E ratio indicates potential overvaluation. However, a strong dividend yield combined with an upward trajectory in target prices suggests a gradual appreciation of value over time.

Is the stock good to Buy?

Bull Case

- Strong market presence in IT services.

- Diversification across various sectors.

- Continuous investments in technology.

Bear Case

- A high P/E ratio suggests overvaluation.

- Dependency on global market trends.

- Competitive pressure from larger firms.

Conclusion

With a balanced risk-reward profile, Accel Ltd. remains a viable investment option for those with a long-term perspective. Continued monitoring of market conditions and company performance is essential.

- ADM Stock Price Prediction and analysis (2025 to 2030) - January 2, 2025

- Silver Elephant’s Stock Drops 50% After Pulacayo Mining Contract Termination - December 31, 2024

- Adobe (ADBE) Stock Price Prediction and Analysis (2024-2030) - December 31, 2024