Albemarle Corporation (NYSE): It is the prominent name in the specialty chemicals industry where the company’s biggest focus is on its leadership in lithium production (ALB). And as EVs and renewable energy storage continue to grow, it is lithium that powers them, so Albemarle is a central player in the ongoing energy transition.

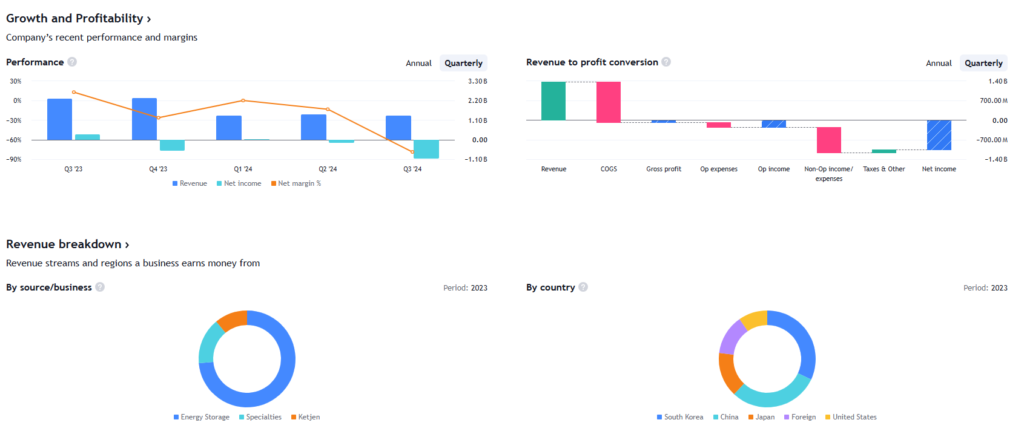

The company is structured around three primary segments: Specialties, Energy Storage and Ketjen. According to data compiled by Wall Street Journal on January 3, 2025, Albemarle’s stock costs $85.82 on a 52-week range price of $71.97 to $143.19, indicating its high market volatility. The feedback they’re revealing with this wide range underscores the dynamic, variable nature of the lithium market and Albemarle’s capacity to respond to global demand trends.

Table of Contents

Company Financials

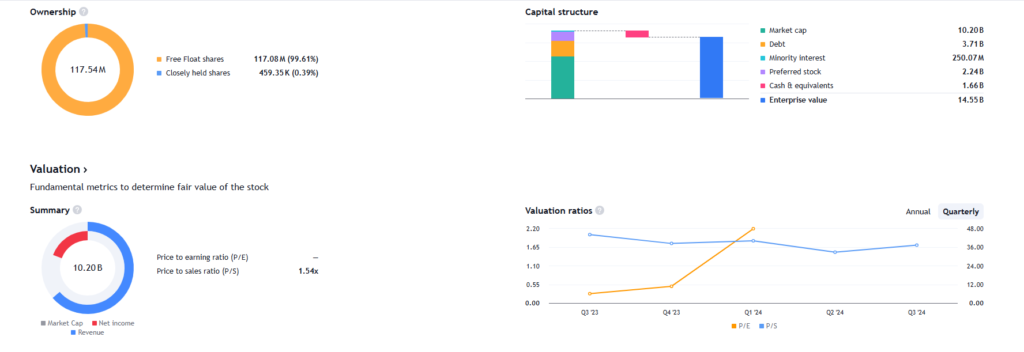

Albemarle’s reported 2023 revenue of $9.62 billion represented a stellar 31.38 per cent increase year on year. However, this growth has seen net income plunge 41.50%, down to $1.57 billion due to higher operating costs, and market adjustments. Therefore, of the trailing twelve months (TTM) by September 30, 2024, total revenues amounted to $6.50 billion, including a large net income loss of $1.97 billion.

It’s the loss of additional costs and impairments due to strategic expansion activities. On the plus side, Albemarle’s cash balances grew 3.92% year on year, to $1.67 billion. It offers this liquidity as a buffer in order to meet company operational and project needs as they continue.

Stock Price Analysis (2024–2030)

2024 Outlook

Market Factors: It’s a certitude that the demand for lithium rising from the EV sector and renewable energy storage will drive the growth. Albemarle’s strategic investment in the lithium carbonate and hydroxide manufacturing benefits its competitive position, given the particular nature of battery technology.

Price Forecast: The stock is expected to rise to $115.95 by the end of the year, over the course of which it will gain 35.3 percent from current levels, they forecast. Sustained demand and improved operational efficiencies are needed to make this projection work.

2025 outlook

Key Developments: Long term supply agreements with major EV manufacturers will benefit Albemarle to an earnings recovery. We expect these contracts to be one of stabilization of revenue streams and predictable growth.

Price Forecast: Lithium processing technologies can allow the stock price to climb to $130 as steady demand keeps rising.

2026–2027 Outlook

Growth Outlook: This period will see an expected fast growth in how many EVs will be sold, helping generate about 20% per annum revenue growth for Alvemarle. The meeting of the market demands will require investments in expanding the production capacity and in operational optimization.

Price Forecast: The stock price is expected to fall within $140-$160 from market analysts. The upper end of this range is based on our optimism about Albemarle’s success in the market as a result of favorable economic conditions.

2028–2030 Outlook

Market Trends: At this point the lithium market may move into a more mature stage with stabilized pricing and supply demand dynamics. Albemarle’s expansion to the bromine chemical sector and lithium recycling will help fund its revenue.

Price Forecast: If it manages to achieve its plans for growth, and if the market remains stable; the stock comes into $180 or higher by 2030.

Long-Term Outlook (2030–2050)

Beyond the end of the decade, Albemarle’s future growth path will be heavily influenced by EV adoption and the rate of progress in energy storage technology. Over the long term, the industry faces decarbonization initiatives from across all industries, which will sustain lithium demand. By 2050, if Albemarle keeps achieving new highs in growth and market share, its stock could increase by more than 3 times. This long term outlook rests on assumption of consistent execution of strategic business and resilience to market fluctuations.

Financial Position

- Assets: Total assets for Albemarle are $17.45 billion, including $9.38 billion in property, plant, and equipment and $1.18 billion in long-term investments. This is what these assets are, the backbone of its production capabilities and future expansion plans.

- Liabilities: Total liabilities of $6.79 billion, including $3.46 billion of long term debt. This is manageable debt, but if interest rates rise or cash fail, it could become a problem.

- Liquidity: An Albemarle current ratio of 2.44 expresses healthy short term finances which enable Albemarle to weather market vagaries and fund growth pursuits.

- Margins: Current ongoing operational challenges are reflected in Albemarle’s negative (-30.26% TTM) profit margins. Meanwhile, however, margin improvements are expected as the market condition stabilizes and cost reduction measures start to gain effect.

Market Cap History and Analysis (Last 10 Years)

Albemarle Corporation, a major player in the lithium production industry, has experienced significant fluctuations in its market capitalization over the past decade.

| Year | Market Cap (USD Billion) | % Change |

|---|---|---|

| 2014 | 4.71 | -8.81% |

| 2015 | 6.28 | 33.56% |

| 2016 | 9.68 | 54.06% |

| 2017 | 14.13 | 45.96% |

| 2018 | 8.19 | -42.08% |

| 2019 | 7.74 | -5.38% |

| 2020 | 15.70 | 102.78% |

| 2021 | 27.35 | 74.12% |

| 2022 | 25.41 | -7.09% |

| 2023 | 16.96 | -33.26% |

| 2024 (Current) | 10.13 | -40.33% |

Over the last 10 years, Albemarle has seen a compound annual growth rate (CAGR) of approximately 9.80%. However, its market cap decreased significantly in 2023 and 2024 due to market headwinds, including high production costs and volatile lithium demand.

Comparison with Other Stocks

Albemarle operates in a competitive market alongside key players such as Linde, BHP Group, and Rio Tinto. Below is a comparative analysis of market cap among industry giants:

| Company | Market Cap (USD Billion) |

| Linde | 198.68 |

| BHP Group | 124.67 |

| Rio Tinto Group | 100.99 |

| Albemarle | 10.13 |

While Albemarle lags behind in market cap compared to its peers, its niche focus on lithium gives it a unique growth potential. Its ability to cater to electric vehicle (EV) demands makes it a critical player in the industry.

Stock Recommendation by Analysts

Here’s a snapshot of analyst sentiment:

| Recommendation | % of Analysts |

| Strong Buy | 30% |

| Buy | 25% |

| Hold | 35% |

| Sell | 10% |

Analysts maintain a cautiously optimistic view, highlighting the need for operational efficiency and market stabilization. The consensus recommendation leans towards “Hold” as Albemarle navigates through market challenges.

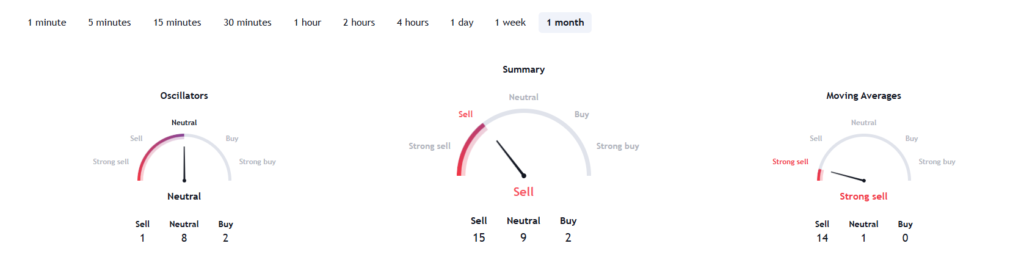

Indicator-Based Stock Analysis

Technical Indicators:

| Indicator | Value | Interpretation |

| Relative Strength Index | 29.94 | Oversold |

| 50-Day Moving Average | $99.71 | Bearish Trend |

| 200-Day Moving Average | $103.10 | Bearish Trend |

| Beta | 1.55 | High Volatility |

| Price-to-Sales Ratio | 1.54 | Fairly Valued |

Financial Indicators:

- Return on Equity (ROE): -17.66% (indicates operational inefficiencies)

- Debt-to-Equity Ratio: 0.35 (manageable debt levels)

- Profit Margin: -28.80% (significant losses impacting financial health)

Dividends

Albemarle has a history of steady dividends despite financial setbacks. The ex-dividend date for 2024 is December 13. Consistent payouts highlight management’s commitment to shareholder returns, even during volatile times.

Overview of Historical Trends

The following table illustrates the yearly closing stock prices:

| Year | Stock Price (USD) |

| 2014 | $60.13 |

| 2015 | $56.01 |

| 2016 | $86.08 |

| 2017 | $127.89 |

| 2018 | $77.07 |

| 2019 | $73.04 |

| 2020 | $147.52 |

| 2021 | $233.77 |

| 2022 | $216.86 |

| 2023 | $144.48 |

| 2024 | $86.08 (projected) |

Key Factors Influencing ALB’s Stock

- Lithium Demand: The global shift towards renewable energy and EVs is a primary growth driver.

- Market Volatility: Prices are influenced by geopolitical tensions and supply chain challenges.

- Operational Efficiency: Improving margins and cost structures remain critical for sustained growth.

Price Forecasts and Analysis

2025 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

|---|---|---|---|

| January | 105 | 110 | +22% |

| February | 107 | 113 | +24% |

| March | 109 | 115 | +26% |

| April | 111 | 118 | +28% |

| May | 113 | 120 | +30% |

| June | 115 | 122 | +32% |

| July | 118 | 125 | +35% |

| August | 120 | 128 | +38% |

| September | 123 | 130 | +41% |

| October | 125 | 133 | +43% |

| November | 127 | 135 | +45% |

| December | 130 | 140 | +48% |

2026 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| January | 132 | 145 | +50% |

| February | 135 | 148 | +53% |

| March | 138 | 150 | +55% |

| April | 140 | 153 | +57% |

| May | 142 | 155 | +59% |

| June | 145 | 158 | +62% |

| July | 148 | 160 | +65% |

| August | 150 | 163 | +67% |

| September | 153 | 165 | +70% |

| October | 155 | 168 | +72% |

| November | 158 | 170 | +75% |

| December | 160 | 175 | +78% |

2027 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| January | 162 | 178 | +80% |

| February | 165 | 180 | +82% |

| March | 168 | 183 | +85% |

| April | 170 | 185 | +87% |

| May | 173 | 188 | +90% |

| June | 175 | 190 | +92% |

| July | 178 | 193 | +95% |

| August | 180 | 195 | +97% |

| September | 183 | 198 | +100% |

| October | 185 | 200 | +102% |

| November | 188 | 203 | +105% |

| December | 190 | 208 | +108% |

2028 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| January | 193 | 210 | +110% |

| February | 195 | 213 | +113% |

| March | 198 | 215 | +115% |

| April | 200 | 218 | +117% |

| May | 203 | 220 | +120% |

| June | 205 | 223 | +122% |

| July | 208 | 225 | +125% |

| August | 210 | 228 | +127% |

| September | 213 | 230 | +130% |

| October | 215 | 233 | +132% |

| November | 218 | 235 | +135% |

| December | 220 | 240 | +138% |

2029 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| January | 223 | 243 | +140% |

| February | 225 | 245 | +142% |

| March | 228 | 248 | +145% |

| April | 230 | 250 | +147% |

| May | 233 | 253 | +150% |

| June | 235 | 255 | +152% |

| July | 238 | 258 | +155% |

| August | 240 | 260 | +157% |

| September | 243 | 263 | +160% |

| October | 245 | 265 | +162% |

| November | 248 | 268 | +165% |

| December | 250 | 273 | +168% |

2030 Price Forecast Table

| Month | Minimum Price (USD) | Maximum Price (USD) | % Change from Now |

| January | 253 | 275 | +170% |

| February | 255 | 278 | +173% |

| March | 258 | 280 | +175% |

| April | 260 | 283 | +177% |

| May | 263 | 285 | +180% |

| June | 265 | 288 | +182% |

| July | 268 | 290 | +185% |

| August | 270 | 293 | +187% |

| September | 273 | 295 | +190% |

| October | 275 | 298 | +192% |

| November | 278 | 300 | +195% |

| December | 280 | 305 | +198% |

Opinion

The outlook for Albemarle appears optimistic based on strong demand for lithium and strategic investments in battery materials. However, operational efficiencies and market stabilization will be critical for sustaining growth. The stock’s medium- to long-term potential makes it a solid consideration for those looking to invest in EV-related markets.

How to Buy This Stock

- Open an account with a brokerage that offers access to NYSE-listed stocks.

- Research Albemarle Corporation’s ticker symbol (ALB) and decide on the quantity you wish to purchase.

- Use limit or market orders to execute your purchase.

- Regularly monitor the stock and adjust your portfolio as needed based on market trends.

- Albemarle Corporation (ALB) Stock Price Prediction and analysis (2025 to 2030) - January 3, 2025

- Brera Holdings Expands Global Reach with 52% Stake in Juve Stabia - December 31, 2024

- Archer Aviation (ACHR) Stock Price Prediction and Analysis (2024-2030) - December 24, 2024