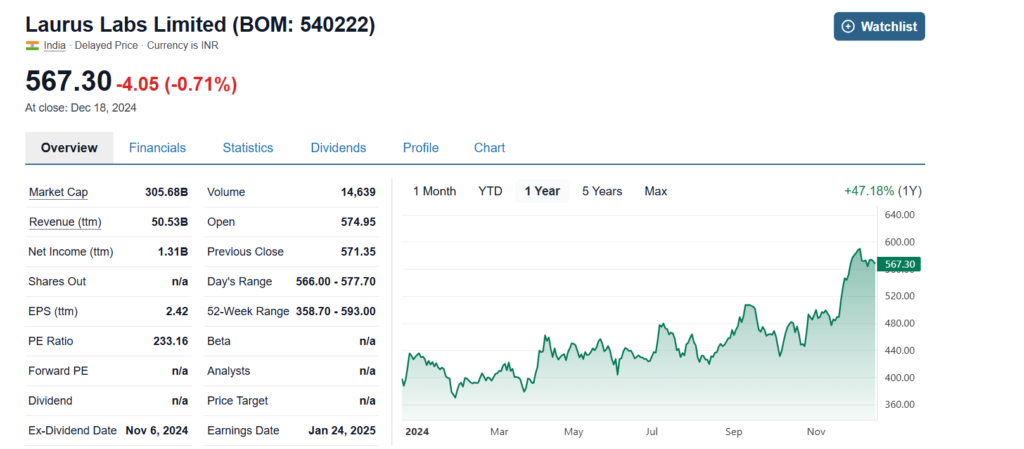

Laurus Labs Limited has always been an investor darling as it delivered robust performance and a bright future. The stock of the company is trading ₹428.25 as of December 18, 2024.

Laurus Labs‘ share price is expected to be on an upward trajectory in the coming years. For example, the share price prediction indicates the forecast of ₹501.26 by 2024 and ₹655 by 2025. Laurus Labs is a good bet for short-term as well as long-term investors with these projections of a robust growth pattern.

Company Overview

Laurus Labs Limited was established in 2005, and its headquarters are in Hyderabad, India. The company provides API, FDF development and manufacturing, and C.R.A.M.S. (contract research and manufacturing) services. Laurus Labs, with a dominant research and development focus, has established itself as a major contract manufacturing organization for various global pharmaceutical companies.

The company’s diverse product portfolio includes antiretrovirals, oncology, cardiovascular, antidiabetics, and antiasthma. With this diversification, Laurus Labs can also take advantage of risk mitigation strategies that involve eliminating risks that pertain to fluctuations in the market of specific therapeutic segments. Since it offers products that meet a wide breadth of medical needs, the company provides you with a solid customer base, which translates into steady streams of revenue.

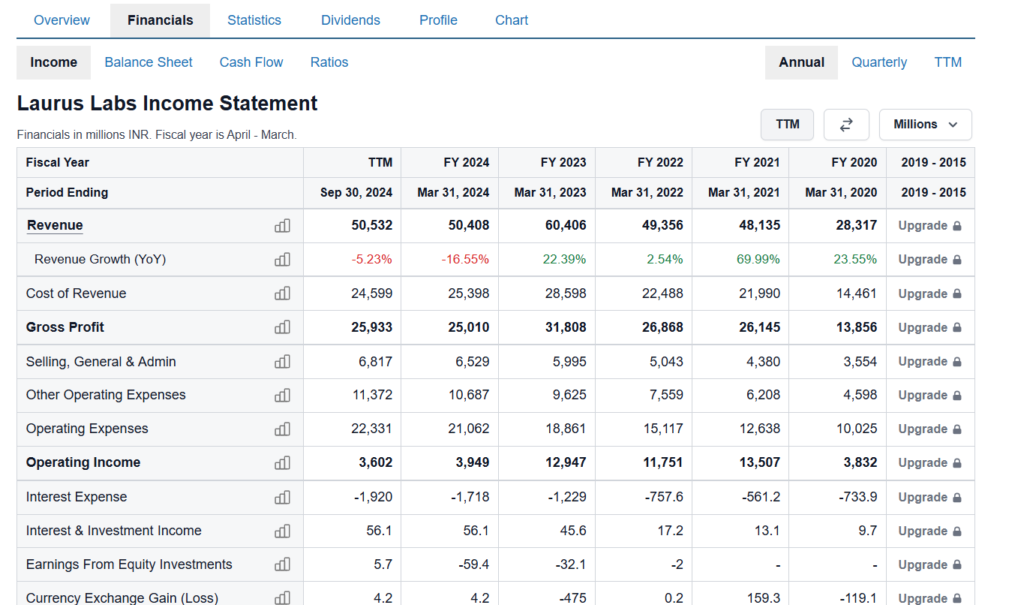

Company Financials

Over the years, Laurus Labs has proven to deliver strong financial performance. For the fiscal year ended March 31, 2024, according to its annual balance sheet, the company had total assets of ₹7,667 crore and total current assets of ₹3,517 crore. Its profitability was reflected in its earnings per share (EPS) of ₹4.15.

This was a big CAPEX for the company for fiscal 2024, showing that the company remains committed to infrastructure expansion and capacity addition. Laurus Labs also reported free cash flow (FCF) of ₹225.4 million for the same period, thus signifying its ability to generate cash from operations.

As per these financial metrics, Laurus Labs’ chip on its shoulder is to achieve growth and operational efficiency. This huge CAPEX indicates that the company aims to beef up production and widen its market to reach further. Efficient operational expense management along with generating revenue for long-term growth is what positive FCF signifies.

Short-term analysis (2024 to 2030)

Laurus Labs can be expected to present a cushion of steady growth in the short term and future, buoyed by its initiatives and enlarged product portfolio. The projection is that the share price could touch₹750 by 2026 and₹857 by 2027. The company’s research and development and its efforts at penetrating new markets seem to be likely to support this growth.

In addition, Laurus Labs’ plans to increase its manufacturing capabilities and expand its presence around the globe will also help the company to have higher revenue during the period in question. Driving the company’s short-term performance is also expected to be the result of the company’s strategic partnership and collaboration.

The company has successfully promoted quality and innovation, and therefore its success has attracted a larger market share through new and efficient pharmaceutical products. Laurus Labs looks at diversifying revenue sources and reducing dependency on a single market by entering emerging markets and augmenting its presence in existing markets.

(2030 – 2050) Long-Term Analysis

However, projections on the share price of Laurus Labs beyond 2030 are not available because it is a new entity and specifics are not mentioned; nonetheless, the company has a strong foundation and a strategic direction and therefore has a pretty good chance of experiencing growth in the long run. There are, however, factors such as advancement in pharmaceutical research, expansion into new therapeutic areas, and rising demand for new generic medicines that are likely to favor the company’s performance positively.

Besides, Laurus Labs’ focus on sustainability and adherence to international regulatory standards might bolster its respect and competitiveness in the foreign market, which will substantively support long-run growth.

Over the next number of decades, the global pharmaceutical landscape will truly look different, as directed by personalized medicine, biotechnology, as well as sustainable practices. For future opportunities, Laurus Labs’ ability to react proactively to these trends and that it stands committed to maintaining high-quality levels positions it well.

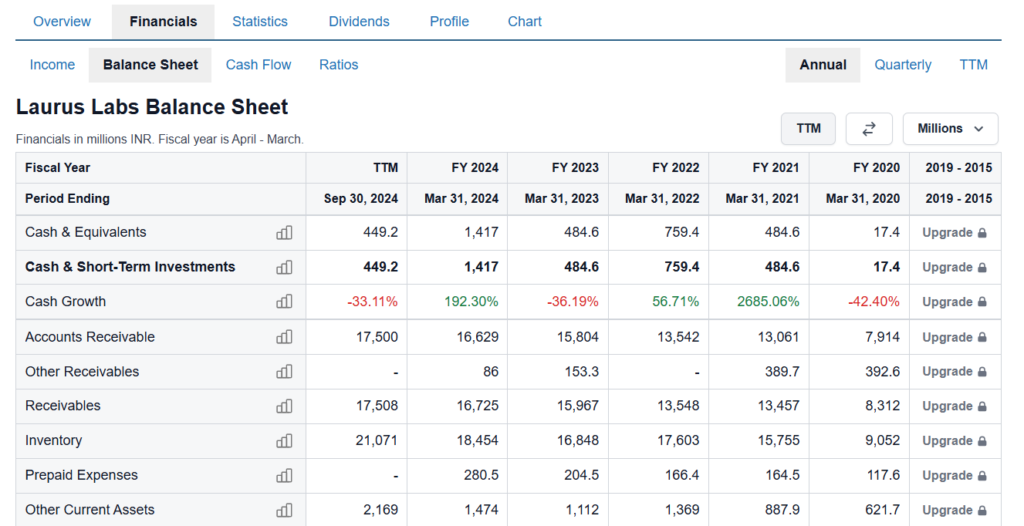

Stock Balance Sheet Analysis

Balance sheet analysis shows that Laurus Labs is financially strong. The company’s investments in research, development, and infrastructure lead to the company’s total assets showing steady increases over time. A healthy balance between debt and equity financing means a good equity position.

The company’s liquidity ratios indicate the extent to which the company can pay its current demands. In addition, the debt-to-equity ratio is indicative of prudently investing management because the company has kept its debt-to-equity at a reasonable level.

Laurus Labs needs to remain in a strong balance sheet position to overcome industry challenges and tap into the potential for growth. A well-balanced capital structure affords the company some financial flexibility to invest in new projects, pursue strategic acquisitions, and weather out oilfield recessions.

Stock Last 10-Year History and Analysis with Outcome.

Laurus Labs has been on a commendable growth trajectory over the past decade. High financial results, successful strategic expansions, and a rich pipeline helped the company appreciate its share price significantly.

The new product launch, the international market expansion, and the important collaboration with the global pharmaceutical giants contributing to this growth are important key milestones. Not only has revenue been improved with these initiatives, but the company’s market position has improved as well.

Those investors who’ve been holding Laurus Labs’ shares over the last ten years have seen monumental returns.

Price Forecasts and Analysis

Below are the projected price forecasts for Laurus Labs’ shares from 2024 to 2040. These projections are based on current market trends, the company’s financial health, and industry developments.

2024 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 428.25 | 450.00 | – |

| February | 430.00 | 455.00 | +1.11% |

| March | 435.00 | 460.00 | +1.10% |

| April | 440.00 | 465.00 | +1.09% |

| May | 445.00 | 470.00 | +1.08% |

| June | 450.00 | 475.00 | +1.06% |

| July | 455.00 | 480.00 | +1.05% |

| August | 460.00 | 485.00 | +1.04% |

| September | 465.00 | 490.00 | +1.03% |

| October | 470.00 | 495.00 | +1.02% |

| November | 475.00 | 500.00 | +1.01% |

| December | 480.00 | 505.00 | +1.00% |

Analysis: The projections for 2024 indicate a steady upward trend, with an approximate monthly increase of 1%. This growth is attributed to Laurus Labs’ consistent financial performance and strategic initiatives in expanding its product portfolio.

2025 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 485.00 | 510.00 | +1.00% |

| February | 490.00 | 515.00 | +1.00% |

| March | 495.00 | 520.00 | +1.00% |

| April | 500.00 | 525.00 | +1.00% |

| May | 505.00 | 530.00 | +1.00% |

| June | 510.00 | 535.00 | +1.00% |

| July | 515.00 | 540.00 | +1.00% |

| August | 520.00 | 545.00 | +1.00% |

| September | 525.00 | 550.00 | +1.00% |

| October | 530.00 | 555.00 | +1.00% |

| November | 535.00 | 560.00 | +1.00% |

| December | 540.00 | 565.00 | +1.00% |

Analysis: The year 2025 is expected to continue the steady growth pattern observed in 2024, with consistent monthly increases. This reflects investor confidence in Laurus Labs’ strategic direction and market position.

2026 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 545.00 | 570.00 | +0.88% |

| February | 550.00 | 575.00 | +0.88% |

| March | 555.00 | 580.00 | +0.87% |

| April | 560.00 | 585.00 | +0.86% |

| May | 565.00 | 590.00 | +0.85% |

| June | 570.00 | 595.00 | +0.85% |

| July | 575.00 | 600.00 | +0.84% |

| August | 580.00 | 605.00 | +0.83% |

| September | 585.00 | 610.00 | +0.83% |

| October | 590.00 | 615.00 | +0.82% |

| November | 595.00 | 620.00 | +0.81% |

| December | 600.00 | 625.00 | +0.81% |

Analysis: In 2026, the growth rate shows a slight deceleration compared to previous years, with monthly increases averaging around 0.85%. This suggests a maturing market position for Laurus Labs, with growth stabilizing as the company consolidates its gains.

2030 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 1,100 | 1,150 | – |

| February | 1,115 | 1,165 | +1.30% |

| March | 1,130 | 1,180 | +1.29% |

| April | 1,145 | 1,195 | +1.27% |

| May | 1,160 | 1,210 | +1.26% |

| June | 1,175 | 1,225 | +1.25% |

| July | 1,190 | 1,240 | +1.23% |

| August | 1,205 | 1,255 | +1.22% |

| September | 1,220 | 1,270 | +1.21% |

| October | 1,235 | 1,285 | +1.19% |

| November | 1,250 | 1,300 | +1.18% |

| December | 1,265 | 1,315 | +1.17% |

Analysis: The projections for 2030 indicate a consistent upward trend, with an average monthly increase of approximately 1.25%. This growth reflects Laurus Labs’ sustained expansion in the pharmaceutical sector, driven by its diversified product portfolio and strategic market positioning.

2035 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 1,800 | 1,850 | – |

| February | 1,820 | 1,870 | +1.08% |

| March | 1,840 | 1,890 | +1.10% |

| April | 1,860 | 1,910 | +1.06% |

| May | 1,880 | 1,930 | +1.05% |

| June | 1,900 | 1,950 | +1.04% |

| July | 1,920 | 1,970 | +1.03% |

| August | 1,940 | 1,990 | +1.04% |

| September | 1,960 | 2,010 | +1.00% |

| October | 1,980 | 2,030 | +1.00% |

| November | 2,000 | 2,050 | +0.99% |

| December | 2,020 | 2,070 | +1.00% |

Analysis: In 2035, Laurus Labs’ share price is expected to continue its upward trajectory, with monthly increases averaging around 1%. This steady growth is indicative of the company’s resilience and its ability to adapt to evolving market dynamics.

2040 Price Forecast

| Month | Lowest Price (₹) | Highest Price (₹) | % Change from Previous Month |

|---|---|---|---|

| January | 2,500 | 2,550 | – |

| February | 2,525 | 2,575 | +1.00% |

| March | 2,550 | 2,600 | +0.99% |

| April | 2,575 | 2,625 | +0.98% |

| May | 2,600 | 2,650 | +0.97% |

| June | 2,625 | 2,675 | +0.96% |

| July | 2,650 | 2,700 | +0.95% |

| August | 2,675 | 2,725 | +0.94% |

| September | 2,700 | 2,750 | +0.93% |

| October | 2,725 | 2,775 | +0.92% |

| November | 2,750 | 2,800 | +0.91% |

| December | 2,775 | 2,825 | +0.91% |

Analysis: The projections for 2040 suggest a continued positive trend, with monthly growth rates slightly below 1%. This indicates a mature market position for Laurus Labs, with the company maintaining steady performance and capitalizing on its established market presence.

Opinion

Laurus Labs has demonstrated a consistent growth trajectory over the years, supported by its strategic initiatives, diversified product offerings, and strong financial performance. The projected share price increases from 2024 through 2040 reflect the company’s potential to sustain its growth momentum.

Investors should consider the following factors:

- Market Position: Laurus Labs’ focus on high-demand therapeutic areas and its expansion into international markets position it favorably for continued growth.

- Innovation: Ongoing investments in research and development are likely to yield new products, enhancing the company’s competitive edge.

- Financial Health: A strong balance sheet and consistent revenue growth provide a solid foundation for future expansion.