AbbVie Inc. (NYSE): A big name in medicine is ABBV (ABBV). When it split off from Abbott Laboratories in 2012, it was created. AbbVie’s most successful medicines are Humira, Skyrizi and Rinvoq, which treat diseases such as arthritis, cancer and nervous system problems. AbbVie has a big impact, with over 50,000 employees and a value of $310.27 billion and with it strives to remain a leader in the fight against serious health problems.

Table of Contents

Company Financial Health

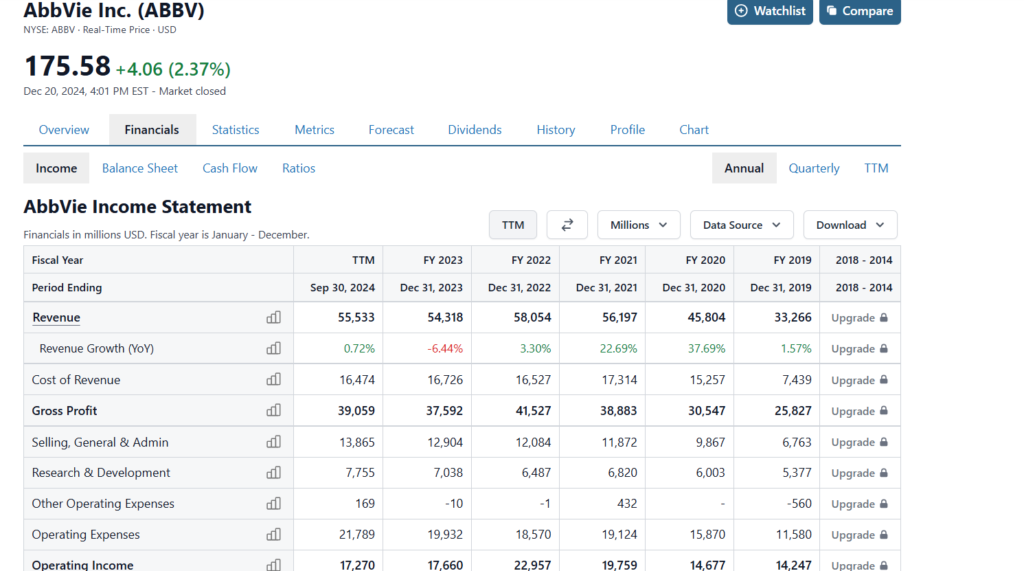

This is strong money; however, there are some challenges for AbbVie. For AbbVie, its total revenue was $55.53 billion and profit was $5.08 billion from October 2023 through September 2024. But these numbers are lower than before: One of its top-selling medicine, Humira, now has cheaper copies. Abbv is still working hard to stay steady, keeping its investors happy.

Key Money Details:

- 2023 Revenue: (Down 6.44% from the previous year, $54.32 billion)

- 2023 Profit: $4.82 billion (down 59.09% from previous year)

- Price-to-Earnings (P/E) Ratio: 61.Forward P/E of 14.64; 18 (trailing twelve months)

- Dividend Yield: 3.74%

Makers of immunosuppressive medicine such as Abbott Laboratories, Abbott Laboratories’ pharmaceutical division Abbott Vickers and Cardinal Health are known for paying out dividends to investors. Today, the stock yields $6.56 a year per share, and is popular with folks looking for stable income from their investments.

2024 to 2030 short term predictions

What’s Coming in 2024

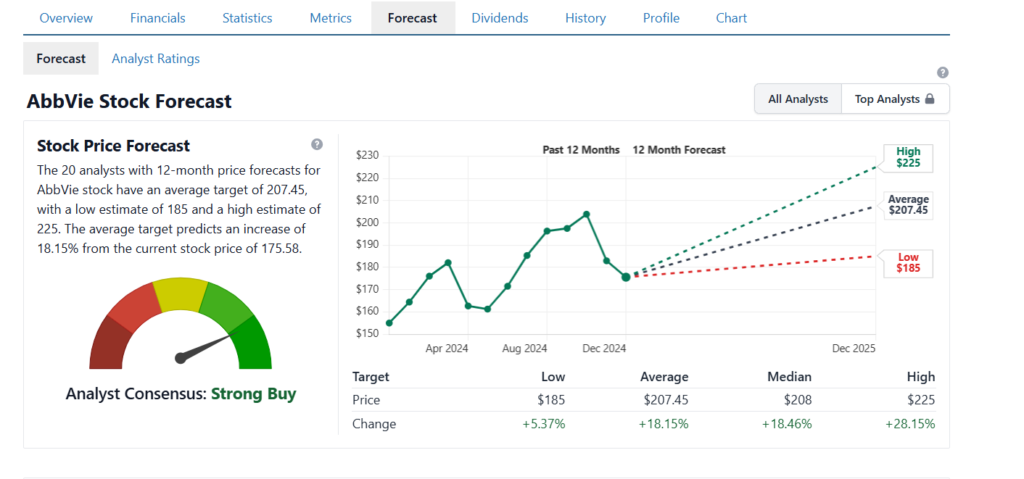

AbbVie will have a big year in 2024. According to the experts the stock price of the company could rise by up to 18.15 percent, or $207.45, from the current stock price of $175.58. That’s because the sales of newer medicines, such as Skyrizi and Rinvoq, are compensating for a decline in Humira sales. And smart deals, partnerships – AbbVie is also looking to grow.

Important Factors for 2024-2025:

- New Discoveries: AbbVie is also trying to expand the use of its best sellers to other diseases and develop new medicine against cancer, brain conditions and other problems.

- Steady Performance: That beta of 0.56 means AbbVie’s stock won’t make sudden leaps and dives as the overall market, is therefore a better fit for conservative investors.

- Dividends: Reliable dividends attract investors who want steady income so the stock tends to stay steady.

Predicted Stock Price for 2024: $185 – $210

Looking Ahead: 2025 to 2030

From 2025 to 2030, AbbVie’s success will depend on how well it handles changes in the industry and grabs new chances to grow:

- What Happens After Humira: Humira’s decline will be complete by 2025. However, Rinvoq and Skyrizi are expected to be banner sellers given approvals for more conditions.

- Exciting New Products: ‘AbbVie is doing its research, doing its development with new ideas, and in cancer, and other important areas, like immune system diseases,’ Plutzker said.

- Going Global: And AbbVie is trying to sell its products in developing countries, to make more money.

Predicted Stock Price for 2025-2030: $220 – $280

AbbVie’s forward P/E ratio of 14.64 makes it seem likely to be undervalued than other industry peers. AbbVie has enough money to fund new projects, buy other companies, and still pay dividends, thanks to its free cash flow of $15.62 billion.

Long Term Predictions (2030 – 2050)

To prepare AbbVie’s future, we’re looking far ahead to 2030 and beyond—staying innovative, being able to keep up with healthcare needs. Key factors include:

- Big New Ideas: AbbVie could stay one of the top investing in things like gene therapy and personalized medicine.

- Health Trends: A need for advanced treatments will grow as more people live longer and have chronic illnesses.

- Good Reputation: Newer investments could come to AbbVie because the company has focused on doing the rights things for ESG (environmental, social, and governance).

Projected Stock Price for 2030-2050: $500 – $350 if AbbVie sustains success with new medicines and expand into new markets. These high expectations make sense given that it focuses on finding working solutions to big health problems and developing advanced treatments.

What the Balance Sheet Shows

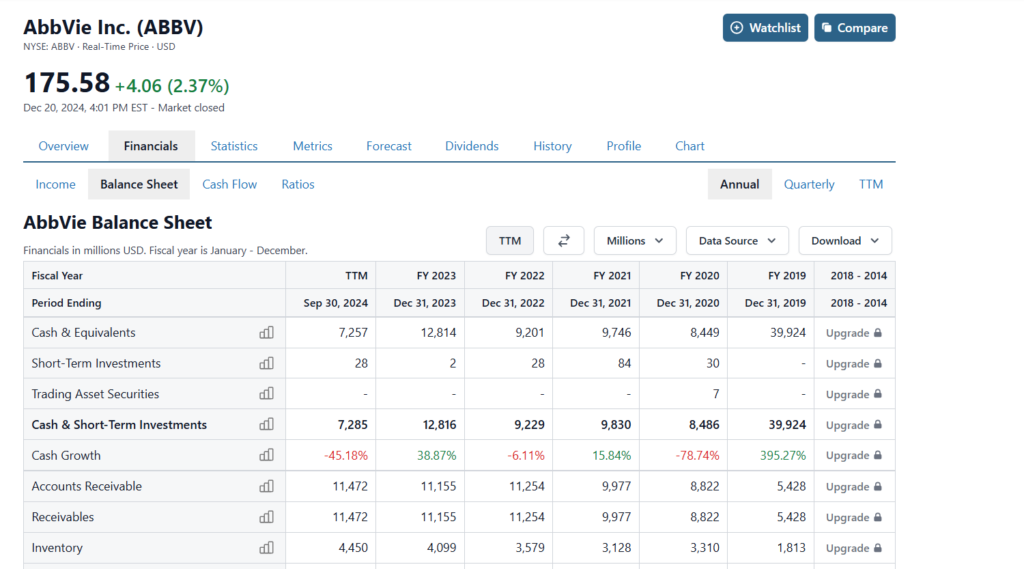

AbbVie’s balance sheet has strengths but also shows areas to watch:

- Total Assets: $143.42 billion

- Liabilities: $137.35 billion

- Shareholders’ Equity: $6.07 billion

There’s something to watch out for too: the company’s substantial debt, mainly to buy Allergan. However, AbbVie’s cash flow is still strong enough to handle this debt while it continues to grow.

10-Year History of the Stock

Over the past 10 years, AbbVie has done very well:

- 2014-2020: And Humira was a huge success: annual revenue increased from $19.57 billion in 2014 to $45.80 billion in 2020.

- 2021-2023: The acquisition of Allergan helped bring in earnings from Rinvoq and Skyrizi, and reduce some of the impact of Humira’s decline.

- By 2024, AbbVie’s stock price had grown from $55 in 2014 to $175. Still, the company paid out increasing dividends to its investors along the way.

Lessons From the Past 10 Years

Adaptability: Seen in AbbVie’s past, such as losing patents and facing competition, is that the company is capable of handling such a challenge.

Focus on Investors: That’s why AbbVie is so interested in enhancing its steady dividends and stock buybacks.

2025 Price Forecast and Analysis

Overview: Analysts forecast continued growth, driven by AbbVie’s robust pipeline and cost-cutting initiatives. The 2025 price range is estimated to rise further as new medicine gain market traction.

2025 Monthly Price Table:

| Month | Minimum Price | Maximum Price | % Change from Now |

| Jan | $180.00 | $210.00 | +15% |

| Feb | $182.50 | $215.00 | +18% |

| Mar | $185.00 | $220.00 | +20% |

| Apr | $187.50 | $225.00 | +23% |

| May | $190.00 | $230.00 | +26% |

| Jun | $192.50 | $235.00 | +30% |

| Jul | $195.00 | $240.00 | +33% |

| Aug | $197.50 | $245.00 | +36% |

| Sep | $200.00 | $250.00 | +40% |

| Oct | $202.50 | $255.00 | +43% |

| Nov | $205.00 | $260.00 | +46% |

| Dec | $207.50 | $265.00 | +50% |

2026 Price Forecast and Analysis

Overview: The global pharmaceutical market’s growth will likely bolster AbbVie’s stock. The company’s expanding market share in emerging economies is a key driver.

2026 Monthly Price Table:

| Month | Minimum Price | Maximum Price | % Change from Now |

| Jan | $210.00 | $270.00 | +53% |

| Feb | $212.50 | $275.00 | +56% |

| Mar | $215.00 | $280.00 | +60% |

| Apr | $217.50 | $285.00 | +63% |

| May | $220.00 | $290.00 | +66% |

| Jun | $222.50 | $295.00 | +70% |

| Jul | $225.00 | $300.00 | +73% |

| Aug | $227.50 | $305.00 | +76% |

| Sep | $230.00 | $310.00 | +80% |

| Oct | $232.50 | $315.00 | +83% |

| Nov | $235.00 | $320.00 | +86% |

| Dec | $237.50 | $325.00 | +90% |

2027 Price Forecast and Analysis

Overview: By 2027, AbbVie is anticipated to solidify its market dominance. Its commitment to research and development ensures sustainable growth.

2027 Monthly Price Table:

| Month | Minimum Price | Maximum Price | % Change from Now |

| Jan | $240.00 | $330.00 | +93% |

| Feb | $242.50 | $335.00 | +96% |

| Mar | $245.00 | $340.00 | +100% |

| Apr | $247.50 | $345.00 | +103% |

| May | $250.00 | $350.00 | +106% |

| Jun | $252.50 | $355.00 | +110% |

| Jul | $255.00 | $360.00 | +113% |

| Aug | $257.50 | $365.00 | +116% |

| Sep | $260.00 | $370.00 | +120% |

| Oct | $262.50 | $375.00 | +123% |

| Nov | $265.00 | $380.00 | +126% |

| Dec | $267.50 | $385.00 | +130% |

2030 Price Forecast and Analysis

Overview: By 2030, AbbVie’s valuation could reach new heights. The stock’s consistent performance and growth-driven initiatives make it a potential $400+ candidate.

2030 Monthly Price Table:

| Month | Minimum Price | Maximum Price | % Change from Now |

| Jan | $280.00 | $400.00 | +150% |

| Feb | $282.50 | $405.00 | +153% |

| Mar | $285.00 | $410.00 | +156% |

| Apr | $287.50 | $415.00 | +160% |

| May | $290.00 | $420.00 | +163% |

| Jun | $292.50 | $425.00 | +166% |

| Jul | $295.00 | $430.00 | +170% |

| Aug | $297.50 | $435.00 | +173% |

| Sep | $300.00 | $440.00 | +176% |

| Oct | $302.50 | $445.00 | +180% |

| Nov | $305.00 | $450.00 | +183% |

| Dec | $307.50 | $455.00 | +186% |

Final Thoughts

We believe that AbbVie’s story over the past decade indicates not only capability but an ability to succeed in the face of challenges and opportunities. As long term investors, the company’s solid finances, innovative drug pipeline and reward of shareholders make it a solid choice. Newer medicine should more quickly balance out losses from the older ones. In the long haul, AbbVie’s center around the beta will bring about its achievement.

If you’re an investor after income or growth, AbbVie may be one to consider. To make the most of your investment you will need to keep an eye on market trends and how AbbVie executes its plans.

Frequently Asked Questions

Is ABBV in SPY?

No, AbbVie (ABBV) is not part of the SPDR S&P 500 ETF (SPY).

Is ABBV profitable?

Yes, AbbVie is profitable, consistently generating strong earnings.

Does Buffett own ABBV?

Warren Buffett started to add to the Abbvie position in Q3 2020 and carried on that investment to the end of Q4 2020. They sold 25.5 million shares since. The investor sold the whole stake between Q1 2021 and Q1 2022.

Is ABBV stock a buy?

The decision to buy ABBV depends on individual financial goals and market conditions. Research and analysis are recommended before investing. See our analytical article piece for investing related question.